Performing operations with non-deliverable financial instruments using simple moving averages

Let’s look at how to use the capabilities of simple moving averages to complete transactions with non-deliverable OTC financial instruments.

Any investment strategy should include specific information about when to open a making investment transactions ( entry point), as well as a risk management system to reduce your losses. This increases the overall probability of success in the long run.

Simple moving averages

One of the most popular technical analysis tools is the simple moving average, which is calculated by adding the closing prices of the market instrument over the selected number of periods and then dividing the result by the number of periods.

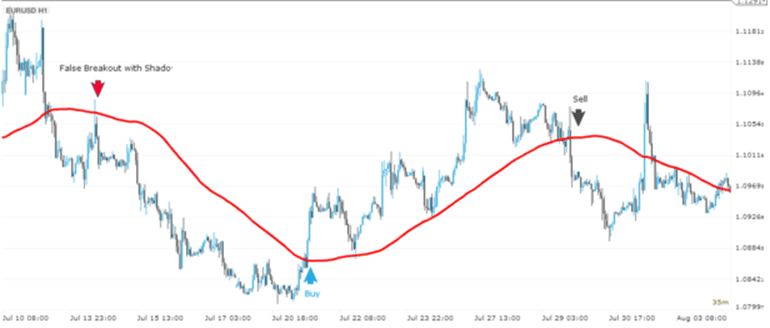

The General rule is that when the price breaks through the average from top to bottom (and this should be the body of the candle, not just its shadow), this is a signal that the bears are gaining strength and there is a high probability of a market fall.

On the other hand, if the price breaks through the average from the bottom up, with the body of the candle, it is a signal that the bulls are gaining strength and that there is a probability of beginning to grow.

If you want, you can use several different periods of moving averages, especially since many company client do so using indicators with different periods at the same time ( for example, 50 and 100 or 100 and 200). So they try to filter out false signals and get reliable entry points, as well as catch the moments of a trend reversal.

Below you can find an example of a EUR/USD chart with an 89-period moving average:

Of course, it is extremely important to determine the point of entry into the market, but it is equally important to determine the moment when transactions with no – deliverable OTC financial instruments should be completed, regardless of the current result-profit or loss. There is an opinion that OTC investment is the art of earning a lot when the market moves under the client ‘s expectations and losing as little as possible when the market goes in the opposite direction from expectations.

To do this, you must know exactly which of your strategies gives the best entry points and carefully follow the intended algorithm.