Management of opened transactions and the current profit

Investment operations in OTC marketsForex is very much tied to the concept of probability.

Therefore, you should not only monitor the number of profitable operations, but also do everything to take the maximum profit when the market goes in your direction, and lose as little as possible when you do not guess the direction.

In the previous lesson, we already talked about the importance of the «profit-risk» ratio, and now we will continue this topic, adding to it the methods by which clients can manage their open positions, increasing the potential income.

In this lesson, we will assume that the minimum acceptable «profit-risk» ratio is 1: 3. This means that when a client makes money, they must earn at least three times as much in a single making investment transactions as they usually lose. Why did we choose this ratio? The fact is that it allows you to make a profit with a small number of profitable transactions. Based on this scenario, let’s look at the following example:

- When a customer guesses the direction of the market and closes with a profit, they earn $300.

- When a client closes a losing position, they lose $100.

With this ratio, the client will make a profit even if the probability of success of each of its operations is only 30%, which is easy to calculate:

30 profitable transactions x $300 profit = $9000

70 losing client x $ 100 loss = $ 7000

Net profit = $ 2000

At first glance, it may seem that the rate of profitable client only 30% is positive, but the above example demonstrates that even with such transactions, non-deliverable financial instruments actually achieve success in the OTC Forex in the Republic of Belarus.

Based on this ratio, we will develop an algorithm for managing open positions. For example, when opening a making investment transactions, we determined the maximum acceptable amount of loss and set a Stop loss. If we use a 3:1 ratio between profit and risk, then as soon as the profit reaches an amount three times higher than the Stop loss, we will have two options:

- Close the transaction. Closing a transaction with a profit three times the potential loss is a very good idea. However, you should take into account the emotions that you will experience if the market continues to move in the same direction after you close the position. This is a very difficult moment from an emotional point of view, and many clients begin to “play catch-up “, trying to make up for lost profits. Unfortunately, these games are based solely on emotions and subsequently lead to losses.

- Change Stop loss. After the position has reached its target, you can move the stop loss to a level below the current price, but above the opening price (if the transaction is for purchase). This way you guarantee yourself some profit, and at the same time get a chance to get a higher profit. In this case, the difference between the current price and the new stop loss is the price you are willing to pay to find out if the market will give you the opportunity to get a higher profit.

An example of a stop loss shift

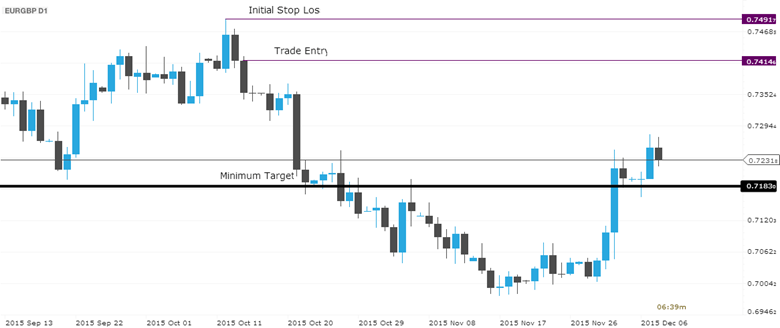

In this example, the client opens a short position on the EUR/GBP pair, setting a stop and take the ratio of 1:3.

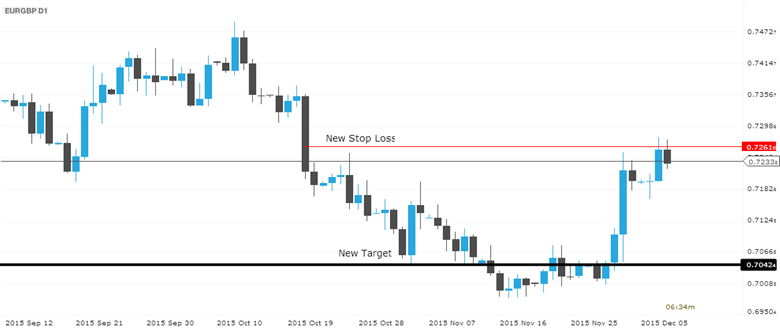

After the market reaches the client’s goal, it moves its stop loss to a new level and similarly transfers the take profit, providing an opportunity to increase profits within a single transaction.

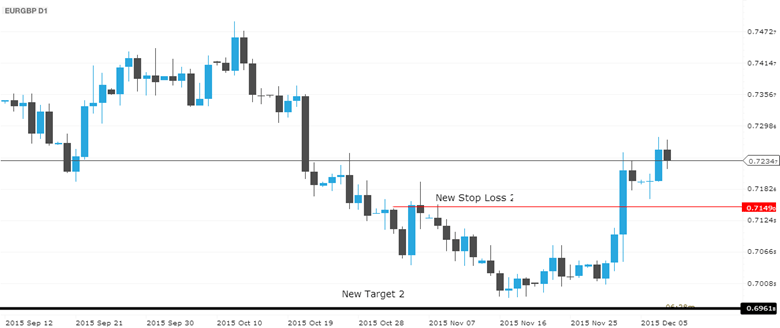

Next, the market reaches the client’s new goal, after which he decides to repeat the previous actions, modifying the Stop loss and Take profit. However, this time the market turns around and closes the transaction on a new stop. At the same time, if we look at the chart, we will see that the initial target profit for the transaction was 231 points ( a drop from 0.7414 to 0.7183), and after closing the last stop at 0.7149, the client took 265 points, that is, even more than he had originally planned.

In addition to the above two scenarios for managing open transactions, there are several other options that help maximize profits while maintaining the emotional comfort of the client:

- Transfer of an order to fix the price of the underlying asset Stop loss to breakeven.

The main idea of this method is very simple: when the market passes a certain number of points, we simply transfer the protective order to fix the price of the underlying asset to the level of opening the transaction. This method really provides emotional comfort, because you know that in the most unfavourable development of events, your transaction will simply close with zero results. - Shifting the stop based on previous vertices and levels.

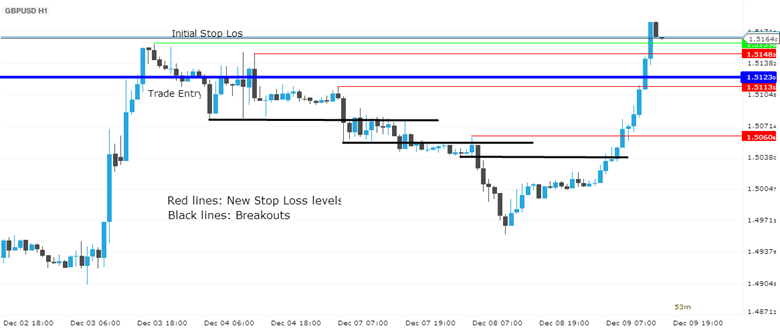

The main idea of this strategy is that when the market breaks through the next maximum on an uptrend, you can move the stop and put it just below the close of the previous investment day, or to another safe level below the last support. And similarly with a downtrend: after breaking another low, you move the stop just above the previous top or above the previous day’s close.

Examples of Stop loss modification based on previous highs can be seen on the chart below.

Here, the client opened making investment transactions at the blue line level and placed a stop order to fix the price of the underlying asset on the green line, near the last maximum. After that, at each of the breakouts of the next bottom, the client moved the stop loss beyond the level of the corrective movement, just above the new maximum. When the downward movement was completely exhausted, the market turned around and closed at the last Stop loss.

In conclusion, we would like to note that there are many different methods of managing open transactions that allow you to take as much income as possible from each movement. By managing risks correctly, the client can achieve a significantly higher profit-risk ratio than in the examples we have considered. Many professionals close deals with a ratio of 8:1 or higher, thus squeezing almost all the profit from the market trend.