The review of the pairs EURUSD, GBPUSD, USDJPY on June 18, 2020, on the Forex

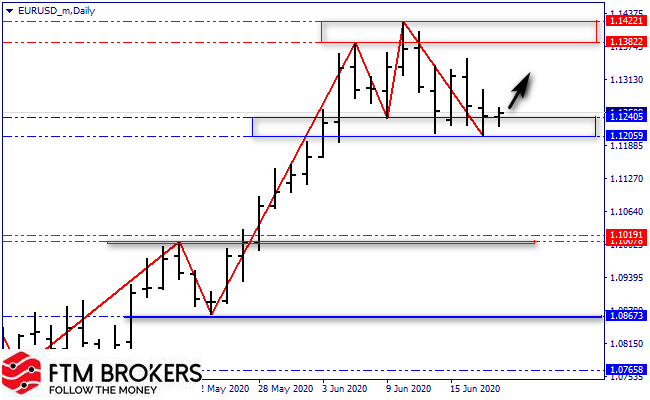

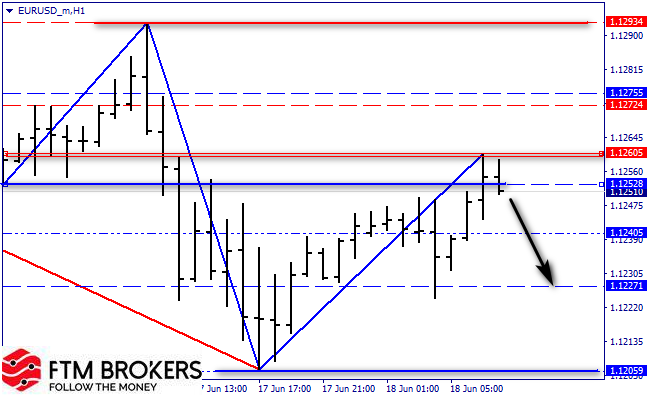

EURUSD

The daily chart: the bear swing updated the low. However, the bullish inside bar breakdown down turned out to be false. Thus, a corrective upward swing likelihood development remains, which, as we recall, needs to test zones 1.1382 before a full turn down. After all, this is where the entrance to the bearish O&U pattern is located.

Н1: the local structure still retains a downward character, and, as we see, the upward correction cannot reach the last peak yet. This characteristic corresponds to the bear market, therefore it cannot be ruled out that we will see another decline in today’s Investment session framework.

The conclusions: a decline to 1.1205 and then a new upward reversal.

Investment solutions:

- The sales to 1.1205

- The search for possible local signals for purchases in the 1.1205 zone

GBPUSD

The daily chart: upward swing development is still very chaotic and has a flat nature. Nevertheless, the quotes growth probability will remain, because the structure still needs a fully stocked bull swing.

Н1: the local structure, as we see, has an extremely small growth amplitude, which again raises suspicions about the flat continuation. However, there are no upward swing stop signs, so it cannot be ruled out that the bulls will reach 1.2650.

The conclusions: growth to 1.2650.

Investment decisions: the purchases to 1.2650.

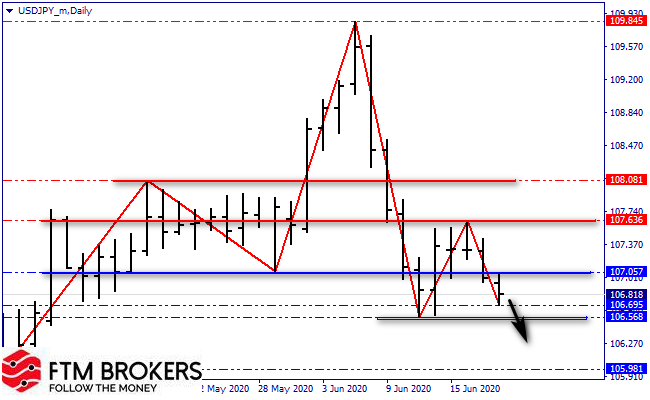

USDJPY

The daily chart: the bear pin bar development continues, which, as expected, became a good decline signal. In the very near future, sellers may attempt to attack support 106.568, where the bottom is located.

Н1: the local descending structure is in the trend development phase, so here you can also make a forecast about a further decrease in the quotations in the 106.500 and below direction.

The conclusions: the decline to 106.500 and below.

Investment solutions: the sales to 106.500 and 106.000.

Invest in the Forex market in Belarus with FTM Brokers!